FULL TEXT OF THE ORDER OF COMPETITION COMMISSION OF INDIA

The present Report dated 10.12.2019 has been received from the Director-General of Anti-Profiteering (DGAP) after a detailed investigation under Rule 129 (6) of the Central Goods & Service Tax (CGST) Rules, 2017.

2. The brief facts of the case and findings of investigation conducted by the DGAP are as under:-

i. A reference was received from the Standing Committee on Anti-profiteering on 28.06.2019, to conduct a detailed investigation in respect of an application dated 06.03.2019, filed by the Applicant No. 1, under Rule 128 of the CGST Rules, 2017, alleging profiteering by the Respondent in respect of supply of “Services by way of admission to exhibition of cinematography films”. The Applicant No. 1 had alleged that the Respondent did not pass on the benefit of reduction in the GST rate on the movie admission tickets, from 18% to 12% w.e.f. 01.01.2019, vide Notification No. 27/2018-Central tax (Rate) dated 31.12.2018 and instead, increased the base prices to maintain the same cum-tax selling prices.

ii. The above application was examined by the Standing Committee on Anti-profiteering, in its meeting held on 15.05.2019, the minutes of which were received by the DGAP on 28.06.2019, whereby it was decided to forward the same to the DGAP to conduct a detailed investigation in the matter. Accordingly, it was decided to initiate an investigation and collect evidence necessary to determine whether the benefit of reduction in rate of tax had been passed on by the Respondent to the recipients in respect of supply of “Services by way of admission to exhibition of cinematography films” supplied by the Respondent.

iii. The Standing Committee had forwarded the following submission/documents of the Applicant No. 1:-

a) Anti-profiteering Application form (APAF-1).

b) Letter dated 03.04.2019 of the Applicant No. 1 to the Standing

Committee on Anti-profiteering.

iv. The DGAP issued a Notice on 08.07.2019 under Rule 129 of the CGST Rules, 2017 to the Respondent after the receipt of the reference from the Standing Committee on Anti-profiteering, calling upon the Respondent to reply as to whether he admitted that the benefit of reduction in rate of tax had not been passed on to the recipients by way of commensurate reduction in prices and if so, to suo moto determine the quantum thereof and indicate the same in his reply to the Notice as well as furnish all supporting documents. Vide the said Notice, the Respondent was also given an opportunity to inspect the non-confidential evidences/information furnished by the Applicant No. 1 during the period 15.07.2019 to 17.07.2019, which the Respondent did not avail.

Vide e-mail dated 25.11.2019, the Applicant No. 1 was afforded an opportunity to inspect the non-confidential documents/reply furnished by the Respondent on 28.11.2019 & 29.11.2019, which the Applicant No. 1 did not avail of.

v. The period covered by the current investigation was from 01.01.2019 to 31.07.2019.

vi. In response to the DGAP’s Notice dated 08.07.2019, the Respondent has submitted his replies vide letters and e-mails dated 18.07.2019, 08.08.2019, 07.10.2019 and 26.10.2019. The replies of the Respondent have been summed up as follows:-

a) Prior to introduction of GST, he had charged the audience Rs. 90/- (for balcony class) which was inclusive of Entertainment Tax. That meant the base prices was Rs. 78.26 /- and the Entertainment Tax was Rs. 11.71/-. In the GST regime the applicable tax rate was 18%. It meant the price to be charged to audience should be Rs. 92.34/- which was inclusive of GST (base price 78.26+ GST 14.08). While he had charged Rs. 90/- to the audience which was inclusive of GST. He had not charged any extra amount because of GST. The Respondent was also claiming to have passed on the benefit to the customers by charging the same amount of Rs. 90/-which included GST (base price 76.27+GST 13.73), thereby reducing the base price by Rs. 1.99 (Rs. 78.26-Rs. 76.27) at the time of implementation of GST w.e.f. 01.07.2017. The price of the movie admission tickets pre & post 01.01.2019 was as follows:-

Table-A

| Name of Category/Class | Price before 01.01.2019 | Price from 01.01.2019 | ||||||

| Ticket Price | GST Rate (%) | GST amount | Total price collected from customer | Ticket Price | GST Rate (%) | GST amount | Total price collected from customer | |

| Balcony | 76.30 | 18% | 13.70 | 90.00 | 89.29 | 12% | 10.71 | 100.00 |

| Dress Circle | 59.00 | 18% | 11.00 | 70.00 | 71.43 | 12% | 8.57 | 80.00 |

| Upper Class | 42.00 | 18% | 8.00 | 50.00 | 53.58 | 12% | 6.42 | 60.00 |

| Lower Class | 16.95 | 18% | 3.05 | 20.00 | 26.79 | 12% | 3.21 | 30.00 |

b) With the notification relating to reduction of GST rate on movie tickets from 18% to 12%, the price to be charged reduced to Rs. 85.42/- (base price 76.27+GST 9.15) but however he had increased the base price to Rs. 89.28/- from 10.01.2019 after obtaining all the necessary approvals from Asst. Commissioner of State Tax, Office of the Commissioner of police and Office of the Inspector of police. The prices of the movie admission tickets for 4 categories pre & post 10.01.2019 have been given in Table-B below :-

Table-B

| Name of Category/Class | Price before 10.01.2019 | Price from 10.01.2019 |

| Balcony | 90.00 | 100.00 |

| Dress Circle | 70.00 | 80.00 |

| Upper Class | 50.00 | 60.00 |

| Lower Class | 20.00 | 30.00 |

The Respondent had further submitted that he had increased the rate of ticket after more than five years i.e. the ticket rate was fixed at Rs. 90/-more than five years back and he had kept it constant even after introduction of GST @18%. Had he collected GST at 18% on Rs. 90/-, he would have charged Rs. 106.2. In January 2019 due to pressure from distributors to increase the ticket price the same was increased. His contention was that there were many theatres within the short distance of 500 meters in the same area and all of them were charging higher rate. As his ticket price was low, he was getting lesser amount of share. So it was only accidental and incidental that his price increase and GST reduction from 18% to 12% occurred at the same time. The increase in ticket price was within the approved amount.

c) Based on the ticket price charged by him and his competitors in the same area, it was clearly evident that he had passed on the benefit to customers by charging Rs. 90/- only, even after introduction of GST@18%. So it was very clear that by not increasing the ticket rate when GST was introduced at 18%, he had passed on the benefit to the customers which has infact created loss to him as he had paid GST at 18% from the ticket price itself (Inclusive of GST basis) without increasing the price of the ticket. The details were as follows:-

Table-C

| Particulars | Ticket Price For Balcony Class | GST Rate | GST Amount | Price Charged In the Industry | Price Charged by the Respondent Including GST | Benefit Given To Audience Per Ticket |

| Before 01/01/2019 | 90 | 18% | 16.2 | 106.2 | 90 | 16.20 |

| After 01/01/2019 | 100 | 12% | 12 | 112 | 100 | 12.00 |

vii. Vide the aforementioned letters; the Respondent had submitted the following documents/information:-

(a) Invoice-wise details of all outward taxable supplies of the movie admission tickets impacted by GST rate reduction w.e.f. 01.01.2019, during the period 01.12.2018 to 31.07.2019.

(b) Price List of the aforesaid movie admission tickets, pre and post 01.01.2019.

(c) Sample copies of the invoice/tickets, pre and post 01.01.2019.

(d) GSTR-1 and GSTR-3B returns for the period December, 2018 to July, 2019.

viii. The Applicant No. 1 had given the illustration with respect to reduction in rate of admission tickets where the price of admission was upto Rs.100/-(One Hundred Rupees) only. Also the Respondent in his submissions has admitted that he had increased the base price from Rs. 76.27 to Rs. 80.36/-for Rs. 90/- ticket, from Rs. 59.33/- to Rs. 62.50/- for Rs. 70 ticket, from Rs. 42.37/- to Rs. 44.64/- for Rs. 50/- ticket and from Rs. 16.95/- to Rs. 17.86/-for Rs. 20/- ticket.

ix. The Central Government, on the recommendation of the GST Council, reduced the GST rate on the product “Services by way of admission to exhibition of cinematography films where price of admission ticket was above one hundred rupees” was reduced from 28% to 18% w.e.f. 01.01.2019 and “Services by way of admission exhibition of cinematography films where price of admission ticket was one hundred rupees or less” were reduced from 18% to 12% w.e.f. 01.01.2019 vide Notification No. 27/2018-Central Tax (Rate) dated 31.12.2018 which has not been contested by the Respondent.

x. Section 171(1) of Central Goods and Services Tax Act, 2017 which governed the anti-profiteering provisions under GST stated that “Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit should be passed on to the recipient by way of commensurate reduction in prices.” Thus, the legal requirement was that in the event of a benefit of input tax credit or reduction in rate of tax, there must be a commensurate reduction in prices of the goods or services. Such reduction can obviously be only in terms of money, such that the final price payable by a consumer got reduced commensurate with the reduction in the tax rate which was the legally prescribed mechanism for passing on the benefit of input tax credit or reduction in rate of tax to the recipients under the GST regime and there was no other method which a supplier could adopt to pass on such benefits. From 01.01.2019, the Respondent, in terms of Section 171 of the CGST Act, 2017, was bound to maintain the Base Price of the tickets across all class of seats/slots and GST should have been charged on the pre rate reduction Base Price.

xi. On examination of the details of sales data, letter of the Applicant No. 1 and replies submitted by the Respondent, the DGAP has observed that basically there were four categories of tickets (Balcony- Rs. 90, Dress Circle-Rs. 70 and Upper Class-Rs. 50 and Lower Class-20) sold by the Respondent during the pre rate reduction period effective from 01.12.2018 to 31.12.2018 and the prices of these four categories of tickets were (Balcony- Rs. 90, Dress Circle- Rs. 70 and Upper Class- Rs. 50 and Lower Class- Rs. 20) after the post rate reduction w.e.f 01.01.2019 which were further increased to Rs. 100 (Balcony), Rs. 80 (Dress Circle), Rs. 60 (Upper Class) and Rs. 30 (Lower Class) w.e.f 10.01.2019.

xii. Now, the issue that remained was the determination and quantification of profiteering by the Respondent, if any, for failing to pass on the benefit of reduction in rate of tax on “Services by way of admission to exhibition of cinematography films where price of admission ticket was one hundred rupees or less” was reduced from 18% to 12% w.e.f. 01.01.2019. From the sales data made available, it appeared that the Respondent increased the base prices of the admission tickets when the GST rate was reduced from 18% to 12% w.e.f. 01.01.2019 in the manner illustrated in Table-D below.

Table-D

xiii. The DGAP has claimed from the above Table-“D” that the Respondent had not only increased the base prices of all the admission tickets to maintain the same selling prices of the ticket but also increased the prices of all the admission tickets w.e.f. 10.01.2019 from Rs. 90/- to Rs. 100/- for Balcony ticket, from Rs. 70/- to Rs. 80/- for Dress Circle, from Rs. 50/- to Rs. 60/- for Upper Class and from Rs. 20/- to Rs. 30/- for Lower Class. Therefore, in terms of Section 171 of the CGST Act, 2017, benefit of GST rate reduction from 18% to 12% in respect of “Services by way of admission to exhibition of cinematography films upto one hundred rupees”, was not passed on to the recipients.

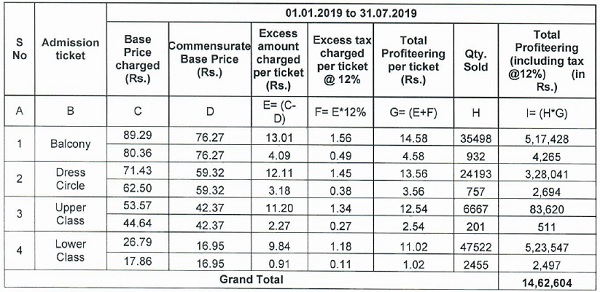

xiv. On the basis of aforesaid pre/ post reduction in GST rates and the details of outward supplies for the period 01.12.2018 to 31.07.2019 submitted by the Respondent, it was observed that profiteering during the period from January, 2019 to July, 2019 from the sale of tickets in four categories mentioned in Table `D’ above amounted to Rs. 5,21,694/- for Balcony, Rs. 3,30,735/- for Dress Circle, Rs. 84,131/- for Upper Class and Rs. 5,26,044/-for Lower Class. The total amount of net higher sale realization due to increase in the base prices of the movie tickets, despite the reduction in GST rate from 18% to 12% or in other words, the profiteered amount came to Rs. 14,62,604/-. The details of the computation have been given in the Table “E” below:-

Table-E

xv. On the basis of the details of outward supplies of the tickets (Services) submitted by the Respondent, the DGAP has observed that the Respondent has sold admission ticket in the State of Telangana only.

3. Consequently, the DGAP has concluded that the allegation of profiteering by way of increasing the base prices of the tickets (Services) by way of not reducing the selling price of the tickets (Services) commensurately, despite the rate reduction in GST rate on “Services by way of admission to exhibition of cinematography films where price of admission ticket was one hundred rupees or less” was reduced from 18% to 12% w.e.f. 01.01.2019, was not passed on to the recipients appeared to be correct. The DGAP has stated that the total amount of profiteering covering the period of 01.01.2019 to 31.07.2019, was Rs. 14,62,604/- (Rupees Fourteen Lakh Sixty-Two Thousand Six Hundred and Four only). The recipients of the services were not identifiable as no such details of the consumers have been provided.

4. The above Report was considered by the erstwhile Authority in its meeting held on 12.12.2019 and it was decided that the Applicants and the Respondent be given an opportunity of hearing on 07.01.2020 and to file their submissions before this Authority. Notice dated 13.12.2019 was issued to the above Respondent asking him to explain why the Report dated 10.12.2019 furnished by the DGAP should not be accepted and his liability for violating the provisions of Section 171 of the above Act should not be fixed. First hearing opportunity was accorded to the Respondent on 19.02.2020. Sh. Srinivas Panja, Proprietor represented the Respondent. Meanwhile, the Respondent had filed Writ Petition (Civil) No. 4568/2020 before Hon’ble High Court of Telangana. The proceedings were stayed by the Hon’ble Court in the present case. The Hon’ble Court vide order dated 27.10.2021 has disposed of the aforesaid Writ Petition directing the Respondent to submit his explanation in response to the erstwhile Authority’s notice dated 13.12.2019. Accordingly, the Respondent vide his letter dated 10.12.2021 has filed his written submissions. Personal hearing in the matter was accorded to the Respondent and Applicants on 09.06.2022 via video-conferencing. Sh. K. Durga Prasad, Advocate, appeared on behalf of the Respondent. While, the Applicant No. 1 did not appear. Sh. Lal Bahadur, Assistant Commissioner appeared on behalf of DGAP. In total several opportunities of being heard have been provided by the erstwhile NAA and the Commission to the interested parties on 07.01.2020, 30.01.2020, 19.02.2020, 05.03.2020, 09.06.2022, 17.08.2023 and 09.11.2023. During the course of proceedings, the Respondent has filed his submissions dated 18.02.2020 wherein he has reiterated the submissions he had filed before the DGAP which are mentioned in Para 2 (vi) supra. The Respondent vide his submissions dated 10.12.2021, 06.06.2022 and 09.06.2022 has inter-alia stated that: –

(a) The Respondent was located at Chikkadpally, Hyderabad and was screening films with valid cinematography license issued by the Licensing Authority and paying the Entertainment Tax and after introduction of GST the Respondent was paying the Tax as per GST Act. The Central Government had reduced the rate of Tax under GST from 28% to 18% and 18% to 12% on the Cinema Ticket admissions with effect from 01.01.2019.

(b) The cinema business was totally a day to day and show to show business and there was no question of having stock in hand. The theatre was screening the films on show basis i.e., daily four (4) shows and weekly Twenty Eight (28) shows. The theatre has no independent right to increase or decrease the ticket prices without obtaining permission from the Licensing Authorities. From 01.01.2019 to 30.09.2019 a number of films were released in his theatre. From 28.12.2018 to 03.01.2019 a Telugu Film “Ishtamgaa” was screened and from 04.01.2019 to 09.01.2019 Film “Bumble Bee” was released. The rates were increased from 10.01.2019 onwards and till this date the old rates were continued. The DGAP has alleged that he had made illegal profit which was totally incorrect as he did not have any stock prior to 01.01.2019. At the most the Tax could be levied for Three (3) days i.e., from 01.01.2019 to 03.01.2019, on the film “Istamgaa” which was screened on the above days. After that a new film was released which totally was a new business and there was no accommodation to stock the films in his premises, therefore, the question of profiteering did not arise in the present case.

(c) In the Cinema business the new film would start on every Friday and end on every Thursday (normally), if the film was running successfully it would continue for further period. His theatre was screening a new film every week and it was not a main theatre. More particularly, there was no question of keeping old material for getting more profit.

(d) The Respondent has no independent right to enhance or reduce the Ticket Rates without permission of Licensing Authority or from Hon’ble Court. The Government of Telangana issued initially G.O. MS. No. 100 dated 26.04.2013 fixing the rates. The G.O. was set aside by the Hon’ble High Court on 31.10.2016 since then, the Government has not fixed the rates and every theatre owner who wanted to increase the rates was making an application to the Licensing Authority and was to approach the Hon’ble High Court for increase in rates. Finally, the Government of Telangana issued G.O. MS. No. 120 dated 21.12.2021 permitting the theatre owners to enhance the rates. In the meantime, the theatre owners made an application on 03.01.2019 for increase in rates for a new film and the said application was endorsed by the Licensing Authority and the same was filed as a document before this Authority also. The allegation made by the DGAP that the theatre owner had not reduced the ticket price on the basis of the reduction of the Tax rate was totally incorrect. The cinema ticket rate included the tax and after introduction of GST the theatre owners mentioned the tax separately and were paying the same. The G.O. which reduced the GST rate was issued from 01.01.2019 and the Respondent did not have any stock which attracted Profiteering. Every show was a new show, and every week new film was released and it was not a new commodity and getting profit for the old stock unlike the goods, would not attract in the case of the cinema business. A new film was released on 10.01.2019 and rates were charged from 10.01.2019 on the basis of the application made by the Respondent. Therefore, reduced tax was implemented and collected with the ticket rate only and there was no chance to gain illegally by the Respondent.

5. The DGAP vide his supplementary Reports dated 25.02.2020 and 29.04.2022 on the Respondent’s submissions dated 18.02.2020, 10.12.2021, 06.06.2022 and 09.06.2022 has submitted as under: –

(a) The DGAP did not look into aspect of costing in the course of investigation of profiteering. As per Section 171 of the CGST Act, 2017, any benefit of rate reduction should be passed on to the buyers. The Respondent has also contended that after a new film was released, it was totally a new business and there was no accommodation to stock in my premises, therefore, the question of profiteering did not arise in this case. The Respondent’s contention was wrong. The Respondent was supplying services by way of admission to exhibition of cinematography films, The services were consumed immediately and therefore, question of stocking services did not arise in the instant case. Also, the words used in the statute were “on any supply” and “to the recipients” which clearly showed that the benefit of reduction of tax had to be calculated on every supply transaction-wise and benefit had to be passed to each recipient.

(b) The Respondent has also contended that there was no question of keeping old material for getting profit. The DGAP has clarified that the Respondent was engaged in supply of services by way of admission to exhibition of cinematography films which were consumed immediately and could not be stocked as was interpreted by the Respondent. In this regard, as per Section 171 of the CGST Act, 2017, “any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices”. There was no mention of age of the material. It only stated that whenever there was rate reduction, such benefit should be passed on to the buyers.

6. Notice dated 11.10.2023 was issued to the Respondent to attend the hearing on 09.11.2023 but he has not appeared inspite of service of the notice therefore, there is no alternative except to proceed against him ex-parte. This Commission has carefully perused all the submissions and the documents placed on record, and the arguments advanced by the Respondent. The Commission needs to determine as to whether there was any reduction in the GST rate and whether the benefit of reduction in the rate of tax was passed on or not to the recipients as provided under Section 171 of the CGST Act, 2017.

Section 171 of the CGST Act provides as under: –

“(1). Any reduction in rate of tax on any supply of goods or services or the benefit of ITC shall be passed on to the recipient by way of commensurate reduction in prices.”

(2). The Central Government may, on recommendations of the Council, by notification, constitute an Authority, or empower an existing Authority constituted under any law for the time being in force, to examine whether ITC availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.

(3). The Authority referred to in sub-section (2) shall exercise such powers and discharge such functions as may be prescribed.

(3A) Where the Authority referred to in sub-section (2) after holding examination as required under the said sub-section comes to the conclusion that any registered person has profiteered under sub-section (1), such person shall be liable to pay penalty equivalent to ten percent of the amount so profiteered:

PROVIDED that no penalty shall be leviable if the profiteered amount is deposited within thirty days of the date of passing of the Order by the Authority.

Explanation: – For the purpose of this section, the expression “profiteered” shall mean the amount determined on account of not passing the benefit of reduction in rate of tax on supply of goods or services or both or the benefit of input tax credit to the recipient by way of commensurate reduction in the price of the goods or services of both.”

7. The Respondent has argued that the cinema business was totally a day to day and show to show business and there was no question of keeping stock in hand. The theatre was screening the films on show basis. The theatre has no independent right to increase or decrease the ticket prices without obtaining permission from the Licensing Authorities. When a new film was released. It totally was a new business and there was no accommodation to stock the films in his premises. In this regard, the Commission finds that the Respondent was supplying services by way of admission to exhibition of cinematography films. The services were consumed immediately and therefore, question of stocking services did not arise in the instant case. Also, the words used in the statute are “on any supply” and “to the recipients” which clearly show that the benefit of reduction of tax has to be calculated on every supply transaction-wise and benefit has to be passed on to each recipient. Therefore, the Respondent’s contention was wrong.

8. The Respondent has averred that he has no independent right to enhance or reduce the Ticket Rates without permission of Licensing Authority or from the Hon’ble Court. It is evident that the State Authority only fixes the maximum price of the tickets. The Respondent was free to sell the tickets at the lower prices i.e. in the event of the reduction of taxes which infact has happened in the subject case. The State Authorities come into picture only when the theatre owner (the Respondent) wants to increase the price of tickets beyond the maximum price as fixed by the State Authorities. Moreover, the Respondent has submitted a copy of the Government of Telangana G.O. MS. No. 120 dated 21.12.2021 permitting the theatre owners to enhance the rates which were effective from 21.12.2021 which is beyond the period of investigation i.e. from 01.01.2019 to 31.07.2019 considered by the DGAP to calculate profiteered amount. Therefore, the above plea of the Respondent is not maintainable.

9. The Commission finds that, as per the details and calculations given in Tables ‘D’ & ‘E’ above, the Respondent has been profiteering by way of increasing the base prices of the tickets (Services) by not reducing the selling prices of the tickets (Services) commensurately, despite the rate reduction in GST rate on “Services by way of admission to exhibition of cinematography films where price of admission ticket was one hundred rupees or less” from 18% to 12% w.e.f. 01.01.2019. From the Table ‘E’ above, it is evident that the base prices of the admission tickets were indeed increased, as a result of which the benefit of reduction in GST rate from 18% to 12% (w.e.f. 01.01.2019), was not passed on to the recipients by way of commensurate reduction in prices charged (including lower GST @ 12%). The total amount of profiteering covering the period from 01.01.2019 to 31.07.2019, comes to Rs. 14,62,604/-.

10. This Commission based on the facts discussed above has found that the Respondent has resorted to profiteering by way of either increasing the base prices of the services while maintaining the same selling prices or by way of not reducing the selling prices of the service commensurately, despite a reduction in GST rate on “Services by way of admission to exhibition of cinematography films where price of admission ticket was one hundred rupees or less” from 18% to 12% w.e.f. 01.01.2019 to 31.07.2019. On this account, the Respondent has realized an additional amount to the tune of Rs. 14,62,604/- from the recipients which included both the profiteered amount and GST on the said profiteered amount. Thus, the profiteering amount is determined as Rs. 14,62,604/- as per the provisions of Rule 133 (1) of the CGST Rules, 2017. The Respondent is therefore directed to reduce the prices of his tickets as per the provisions of Rule 133 (3) (a) of the CGST Rules, 2017, keeping in view the reduction in the rate of tax so that the benefit is passed on to the recipients. The Respondent is also directed to deposit the profiteered amount of Rs. 14,62,604/- along with the interest to be calculated @ 18% from the date when the above amount was collected by him from the recipients till the above amount is deposited. Since the recipients, in this case, are not identifiable, the Respondent is directed to deposit the amount of profiteering of Rs. 7,31,302/- in the Central Consumer Welfare Fund (CWF) and Rs. 7,31,302/- in the Telangana State CWF respectively, as per the provisions of Rule 133 (3) (c) of the CGST Rules, 2017, along with 18% interest. The above amount shall be deposited within a period of 3 months from the date of this Order failing which the same shall be recovered by the Commissioner CGST/SGST as per the provisions of the CGST Act, 2017.

11. It is also evident from the above narration of facts that the Respondent has denied benefit of rate reduction to his customers/recipients in contravention of the provisions of Section 171 (1) of the CGST Act, 2017 and has committed an offence under Section 171 (3A) of the above Act. However, perusal of the provisions of Section 171(3A), under which liability for penalty arises for the above violation, shows that it has been inserted in the CGST Act, 2017 w.e.f. 01.01.2020 vide Section 112 of the Finance Act, 2019 and it was not in operation during the period from 01.07.2017 to 31.07.2019 when the Respondent had committed the above violation and hence, the penalty prescribed under Section 171 (3A) cannot be imposed on the Respondent retrospectively for the said period.

12. Further, the Commission as per Rule 136 of the CGST Rules 2017 directs the jurisdictional Commissioners of CGST/SGST Telangana to monitor this Order under the supervision of the DGAP by ensuring that the amount profiteered by the Respondent is deposited in the respective CWFs as ordered by this Commission. A Report in compliance of this Order shall be submitted to this Authority by the DGAP within a period of 4 months from the date of receipt of this Order.

13. A copy of this order be supplied to all the interested parties free of cost and file of the case be consigned after completion.